Updated July 2024

You may have heard a lot of talk about tips, service charge and tronc recently, as the UK government is getting ready to make some changes to the way in which these are allocated and paid to staff members.

The Employment (Allocation of Tips) Act 2023 achieved Royal Assent in May 2023 and is expected to come into force on 1st October 2024.

The main aim of the act is to ensure that all tips reach service staff, and that they are allocated to staff in a fair way. It deals with tips or service charge which are “employer-received” (ie. paid by card or otherwise to the employer and then paid to the staff member), as well as cash tips which are under the control of the employer to be allocated.

If you want all the details, you can read the full Employment (Allocation of Tips) Act 2023. For an overview and to learn about how Kobas is equipped to facilitate the upcoming changes, continue reading.

What we know so far

Deductions

Currently, employers are able to deduct any amount from the tips pot to cover admin fees, card transaction fees or other costs.

One of the main changes coming into force will be that employers can no longer make these deductions. 100% of tips and service charge must be allocated to staff members.

Timely Payments

Tips must be paid in full to employees no later than the end of the next calendar month after they are received. For example, a tip received on 10th August would be required to be paid to the employee no later than 31st September. This means that employers can no longer use the tips received in busy months to pay staff in quieter months.

Multi-Venue Operations and Head Offices

Once the changes are made, tips that are received at a specific venue must be allocated to the staff in that venue. That means that operators will no longer be able to use the tips received in one venue to pay employees working in another.

Head Office staff may receive tips from certain venues if their job role can be linked to that specific venue. For Example: Area Managers or Sales Executives for particular venues.

Fair Allocations

Tips must be proven to be allocated amongst staff “fairly”, and a new Code of Practice will be written by Government to include practical guidance on how this can be managed.

Guidance is likely to include things like having all staff in the same job role on the same weighting for tips.

Agency Workers

Agency workers will be eligible for the same proportion of tips as directly employed staff, and are subject to the same rules on fair allocation and timely payments.

Regular Wages

It will no longer be legal to alter an employee’s regular wage (hourly rate or salary) in return for a share of tips. It will also be illegal for any guaranteed tips value to contribute to the National Minimum Wage laws.

Documentation and Records

Employers and independent troncmasters will be obliged to publish a clear policy relating to tips and how they are allocated. The policy must explain how the employer complies with the need for “fair” allocation.

Records of tips allocations must be retained for 3 years, and employees may request their personal tips statement as well as the tips statement for a venue, as long as there is no other personal data of other employees included.

Independent Troncs

These arrangements and their tax implications need not change, as long as the arrangement of allocations and payments is compliant with the new rules (ie. paid in full, on time and allocated fairly).

How Kobas is managing these changes

For hospitality operators already using Kobas to manage staff tips, the good news is… no action is needed.

Our system automatically allocates tips based on hours worked and tronc weighting. It takes into account which staff members worked in each venue, ensuring that they’re receiving the correct tips from whichever venue they work in.

Our Hours Export report as part of our reporting and analytics software, shows the tip amount alongside staff members’ regular wage, covering the value of tips received over the same dates as the pay period. This can help management and head office to pay staff on time and in line with the new rules.

When it comes to configuring tronc weightings for staff, Kobas simplifies the process. Head office and management can access a staff member’s dedicated profile and make the adjustments required from there. We recommend reviewing the weightings across your business to ensure that these are fair. For example, that all staff members in the same job role have the same weighting.

To gain more insight into how much each staff member has earned in tips (plus when and where), we advise using the Tips Per Employee By Date report in Kobas Cloud. This allows you to view and track each staff member’s daily earned tips.

Beyond this, we currently have a setting in Kobas System Preferences which allows our clients to withhold a percentage of staff tips. It’s important to note that we intend on retaining this setting for Kobas users outside of the UK where the act will not be law to use. For our UK clients, we are committed to ensuring full compliance with any upcoming regulations before they come into effect.

How can you prepare?

Whether you currently use Kobas or rely on other systems to manage gratuities, ensuring your compliance with the tip regulation changes scheduled for Autumn 2024 is of utmost importance, particularly for those in the hospitality industry. With that in mind, here are some ways you can prepare.

- Understand exactly what the new law entails by reviewing government resources and keeping an eye out for official announcements. This will ensure you have the most accurate and up-to-date information, helping you prepare accordingly.

- Update your policies and procedures in good time, making it transparent for your staff on how tips are collected, shared, and reported.

- Communicate with your team about the upcoming changes – open communication can help alleviate concerns.

- Train your staff, especially management and supervisors who might be responsible for handling tips and reporting.

- Evaluate your tronc system. As we’ve mentioned in this blog, Kobas already calculates tips for staff based on hours worked and tronc weighting. However, other systems may operate differently and could require you to make some adjustments to be compliant.

- Employers must maintain a record of the distribution of tips and service charges. Review your existing system/s and ensure that you have an efficient process in place for this purpose. It’s important to note that your staff holds the right to request access to this information, so having an accessible system for providing this data is imperative.

- If you need assistance with navigating the tip legislation, speak with your tax advisors, accountants, or legal experts. Their expertise can ensure you stay compliant.

To make things simpler, we’ve put together a free Tips Policy template to share with your team 👇🏼

Want to see the Kobas system in action?

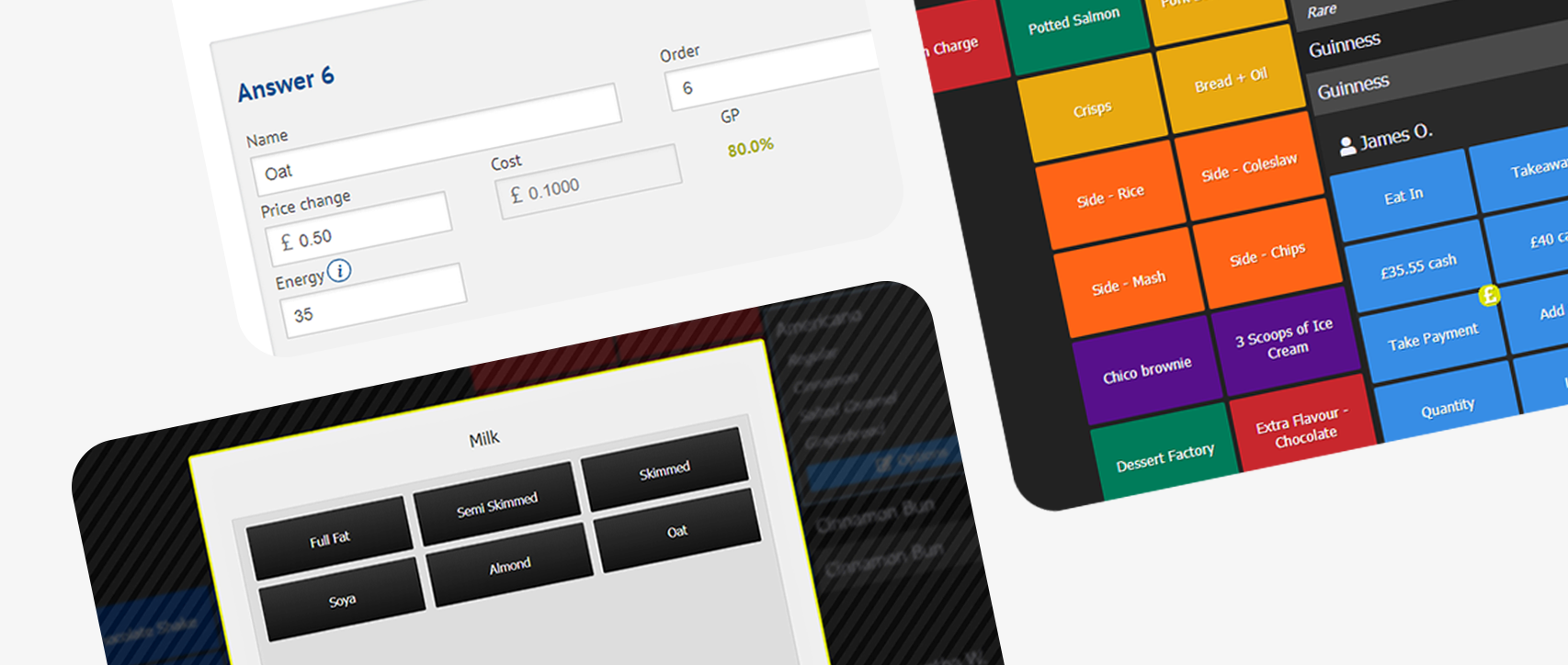

Kobas enables teams across the hospitality industry to manage all areas of the business, from one connected and complete system.