The stats on this page have been provided by the experts over at Worldpay.

Payments

Smooth, secure, and synced with Kobas EPoS. Experience a hospitality payment solution that is ready to serve.

Smooth, secure, and synced with Kobas EPoS. Experience a hospitality payment solution that is ready to serve.

In restaurants, pubs, bars and other hospitality businesses – every second counts. With Kobas Payments, your guests have a fast and stress-free way to pay, while next-day settlements are always on the table for you as the operator. No hold-ups. No hassle.

Next day settlements. Keep revenue moving and get paid the next working day.

An integrated solution meaning fewer manual errors, faster transactions, and easier cashing up.

Next working day swap-out service, reporting, helpdesk services, and more – included.

Contactless payments (Apple Pay, Google Pay, and others supported) along with slick, modern and reliable hardware.

Offline mode and with built-in WiFi and 4G to keep service running even when your WiFi connection checks out.

Our platform doesn’t just take payments – it takes care of your whole business. From stock and staff, to loyalty, insights, and in-venue software such as EPoS, Mobile POS and KDS, our all-in-one system brings every part of your operation under one roof.

And with fast, reliable payments built-in, your tech stack is complete – always ready to serve, sell, and stay on top.

140,000 UK customers supported

150 million transactions processed a day globally

Powered by the #1 UK Acquirer

Whether it’s flat whites at 9am, or full tables at 9pm, our payment system keeps up with your business all day, every day.

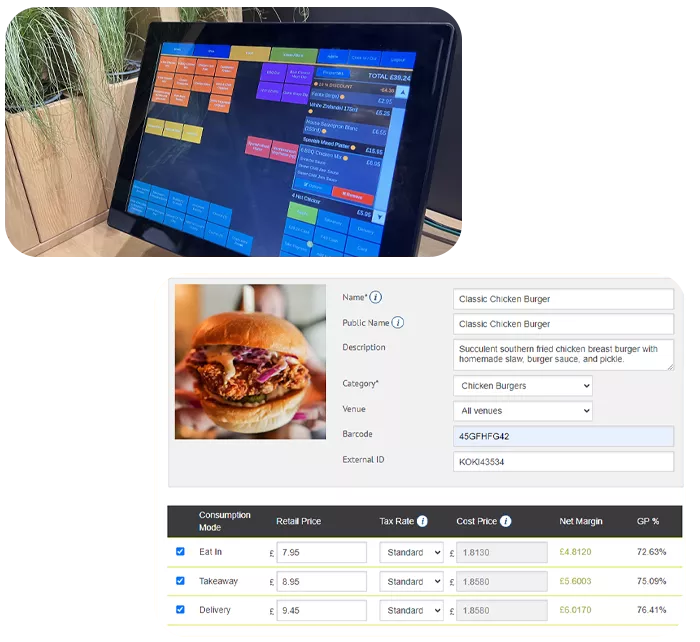

By using Kobas Payments with the Kobas EPoS, your staff no longer need to manually enter bill amounts into the pdq device. Payment amounts are sent directly from the Point of Sale, reducing human error and speeding up every transaction for your team and your customers.

Even better, with built-in WiFi and 4G, you stay connected – so downtime is rare and service keeps moving.

Can I use Kobas Payments with my existing EPoS system?

Kobas Payments works seamlessly with the Kobas EPoS, offering a fully integrated and holistic experience. While it may be technically possible to use it with other systems, our clients get the most value and functionality by using it as part of the complete Kobas platform.

What are the rates for Kobas Payments?

Your rates will depend on your Average Transaction Value and Annual Turnover, along with the split of transactions over the different types of credit and debit cards. We offer fair industry rates and are happy to provide a no-commitment quote to help you explore options.

What costs are involved with Kobas Payments?

There is a small setup fee per device. You can then choose to either:

1. Purchase the device/s outright and then pay a SIM fee per month.

2. Rent the device/s by paying monthly. Rental includes both the hardware and SIM.

What hardware do you supply?

PAX A920 Pro devices are supplied to our clients. These slick devices have leading features for optimum performance such as a 5.5” capacitive touchscreen, PIN on glass technology, front and back camera, scanner, and an A53 processor.

Are tips accepted?

Yes, customers have the option to select or input a tip amount during the card payment process.

What reporting is available with Kobas Payments?

Every client gains access to a Dashboard where all transaction and settlement data can be accessed.

For an extra £10 a month, you can upgrade to a premium version which gives users access to a virtual terminal which can be used to take payments via a browser.

Please note that when using the rest of the Kobas Products, wider reporting is available within Kobas Insights. This includes key data on sales, stock, staff, and customers.

How do I pay my fees?

Businesses can choose how fees are handled – net or gross. With the net option, fees are automatically deducted from your card revenue before you receive it. With the gross option, you receive the full amount, and your fees are invoiced separately each month.

The stats on this page have been provided by the experts over at Worldpay.